| RBGPF | -0.74% | 59.75 | $ | |

| RYCEF | -2.54% | 6.68 | $ | |

| RIO | 0.23% | 62.266 | $ | |

| BCC | -1.85% | 138.965 | $ | |

| RELX | 0.46% | 45.25 | $ | |

| SCS | -1.13% | 13.052 | $ | |

| VOD | -0.06% | 8.915 | $ | |

| CMSC | -0.02% | 24.62 | $ | |

| CMSD | -0.08% | 24.371 | $ | |

| BCE | 0.65% | 27.408 | $ | |

| BTI | 0.42% | 36.835 | $ | |

| AZN | 0.92% | 63.98 | $ | |

| BP | -1.4% | 29.015 | $ | |

| NGG | 0.91% | 63.48 | $ | |

| GSK | -0.78% | 33.43 | $ | |

| JRI | -0.23% | 13.2 | $ |

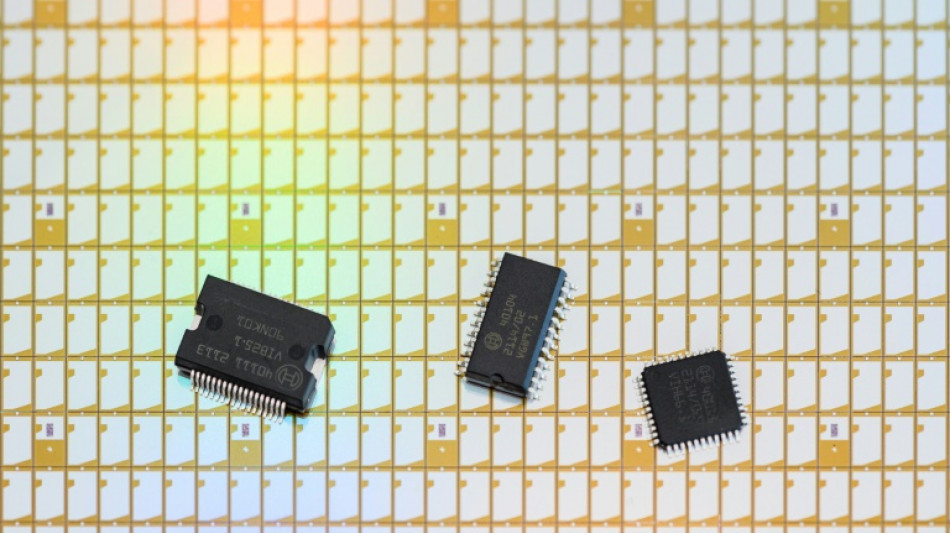

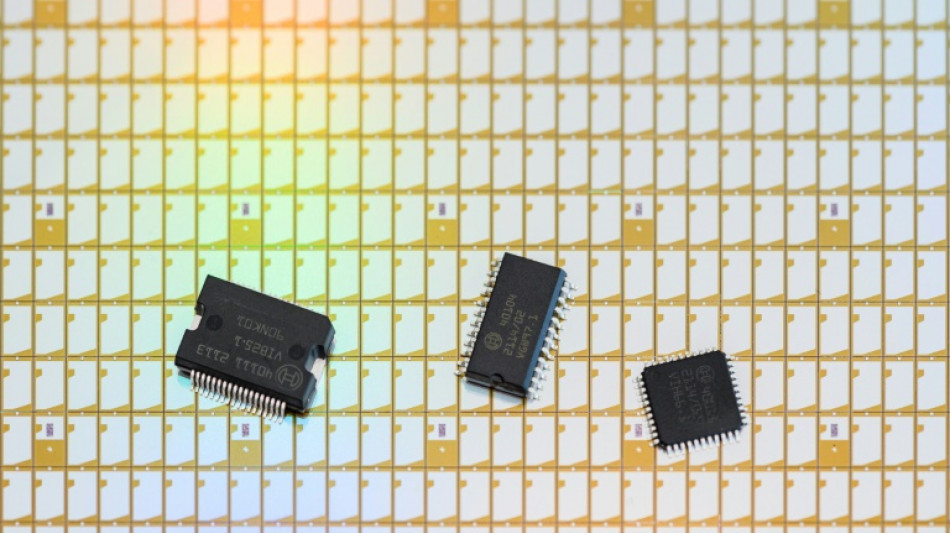

Tech sanctions on Russia a double-edged sword

Sanctions to limit Russia's access to tech components like semiconductors may temporarily hobble its defence industry, but analysts said they risk boomeranging on the West if Russia withholds key raw materials.

Such a move risks pushing Moscow to rely more on China, which will further reduce the West's leverage.

The sanctions the West adopted on Russia over its invasion of Ukraine have mostly targeted the financial sector, but some have begun to limit its access to high-tech components.

Japan, which is home to industrial giant Fujitsu, said Friday it will block exports to Russia of "general-purpose goods such as semiconductors".

While the EU is still considering what steps to take, the United States imposed on Thursday a ban that targets the defense and aerospace sectors and includes semiconductors, computers, telecommunications, information security equipment, lasers, and sensors.

The United States can impose its decisions beyond its borders by threatening to shut recalcitrant companies and countries off from access to key US technology.

That is what the Trump administration did in 2019 when it banned Chinese smartphone maker Huawei from using semiconductors and software that use US technology.

Taiwanese semiconductor manufacturer TSMC, which was a major supplier of chips to Huawei, had to cut off supplies as it used US technology in their manufacturing.

Huawei had to turn to Chinese chip manufacturers, which didn't have the capacity to build semiconductors with as much processing power.

"Of course Russia could strengthen its ties with China but this doesn't mean the transition could happen overnight," said Francisco Jeronimo, an analyst at market intelligence firm IDC.

"Just think about how long it took for Huawei, how tough it is to come up with a solution different from an American company," he told AFP.

However Jeronimo noted that Russia may not be as dependent upon US technology as is believed.

The Russian government announced plans several years ago to shift the public administration off Windows and develop alternatives for the consumer market as well.

- Shortages -

"China is facing exactly the same challenges," said Jeronimo.

"They have been pushing their own technology."

Russia accounts for only one percent of global semiconductor sales, according to the industry's trade association, which means manufacturers will suffer little impact from a loss of sales.

But Moscow could disrupt the global supply chain for semiconductors if it adopts counter-sanctions to block exports of raw materials key for their manufacturing.

At the beginning of February, experts from Techcet, a technology consultancy, published a report showing that the US is dependent upon Russia for imports of the gases neon and C4F6, plus palladium, which are used to manufacture semiconductors.

"Russia is a crucial source of C4F6 which several US suppliers buy and purify for use in advanced node logic device etching and advanced lithography processes for chip production," said the Techcet report.

It said the US uses about 8 million tonnes of C4F6 per year.

Russia is also the top supplier of neon gas -- a side product of steel manufacturing -- which is purified in Ukraine before being exported.

Neon gas is used for the precision laser etching of circuits on silicon wafers.

Russia also produces a third of the world's palladium, a metal used in computer memory chips and catalytic convertors in car exhaust systems.

Supply disruptions in these materials could have consequences for semiconductor manufacturers, which were already having difficulty meeting the spike in demand during the pandemic.

Global auto manufacturers have suffered greatly from the chip shortage, having to idle production lines.

Any disruptions in raw supplies for the semiconductor industry will and the shortages of chips "will definitely last a lot longer. and consumers will pay the price with the device they want to buy," said Jeronimo.

B.Diederich--LiLuX